PUBLIC NOTICE IS HEREBY GIVEN

IN THE MATTERS

__________________________________

AN INFORMATION BY DEFENDANT DANIEL M ROSENBLUM printed August 11 2013 {this information, 30 pages in entirety during August 2013, may be reviewed on the internet unchanged since filing at http://www.twentyfirstcenturydigital.com/amexaug2013.php, where links to additional cited documentation are active for review of such documentation available as of filing date. Additionally, this document will be edited as time permits; the contiuously edited page will be at http://www.twentyfirstcenturydigital.com/amex.php}

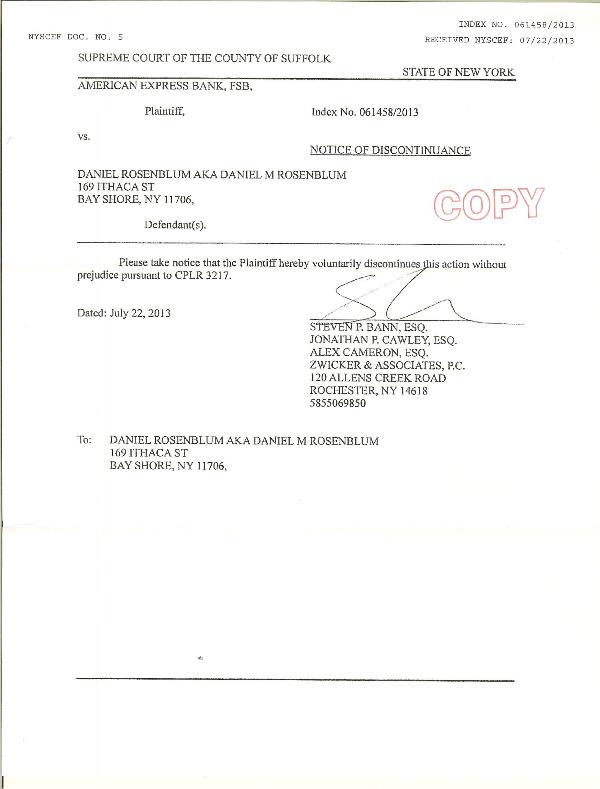

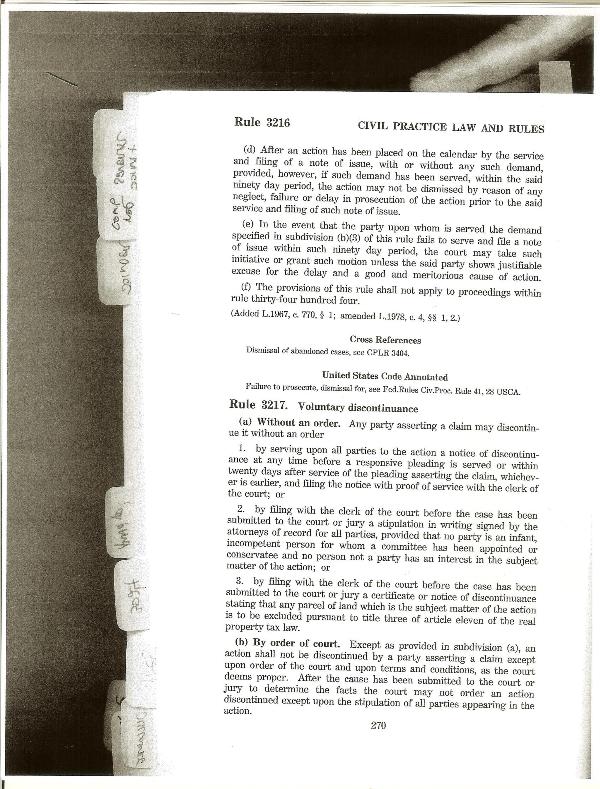

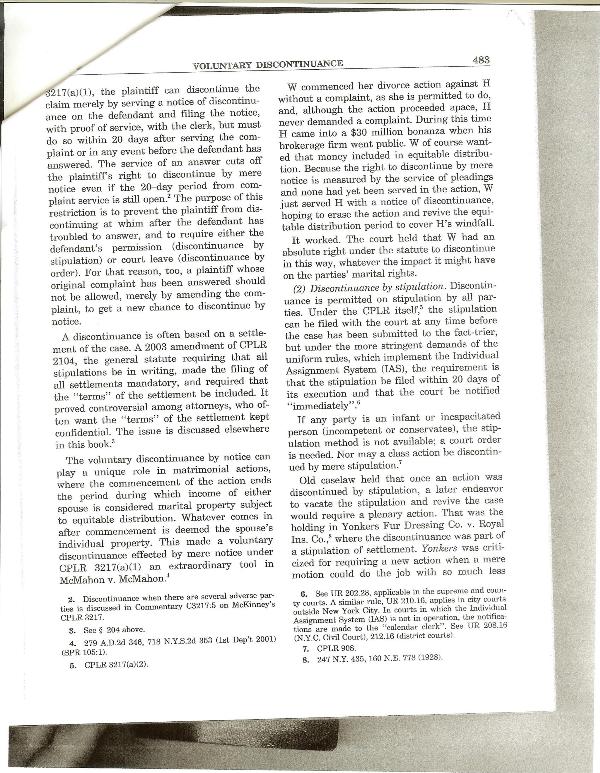

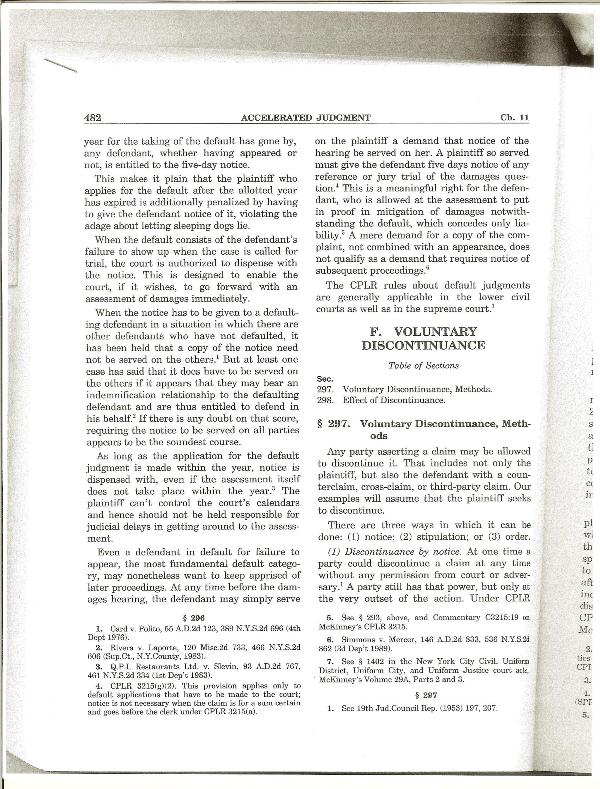

Note the documentation below that both firms, Zwicker P.C. and Jaffe LLP, utilized CPLR 3217 in an effort to discontinue the two identical subject matter actions in New York County and Suffolk County somewhat simultaneously, although New York action brought 2011 and Suffolk action brought 2013. Seemingly both firms have mis-read the statute, and lack comprehension of the meaning/significance of bringing an action in a court of law. If Zwicker were filing according to the book, perhaps their more appropriate filing would be under CPLR 3211(4), Motion to dismiss, and outlined in their affidavit in support of the motion that they Zwicker recognized the subject matter was being heard in Index # 100156/2011.

As defendant, I Dan Rosenblum am of the opinion that the matter of this debt was properly being heard in New York State Supreme Court 60 Centre Street New York County 2011 and continuing. I filed my responsive pleading, a nine page Affidavit in Opposition (see document below) at 60 Centre Street April 2011, Judge Goodman wrote a decision denying Default Judgement. I am not interested in a discontinuance of the action, I do not believe presently that a discontinuance is a just result. There was never any Stipulation to Discontinuance, rather, only an ex parte Notice of Discontinuance which instrument should be deemed a nullity with no weight given the CPLR. My responsive pleading indicates I believe the appropriate resolution is a stay of the proceedings indefinately and then payment in full made to American Express following resolution of the stay of proceedings according to the tolling motion. Below, my April 14th Affidavit of Opposition indicates the same at paragraph 33, page 8.

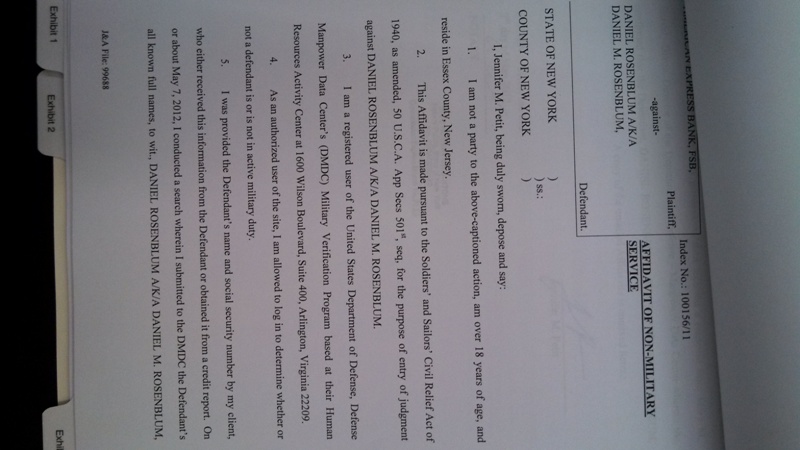

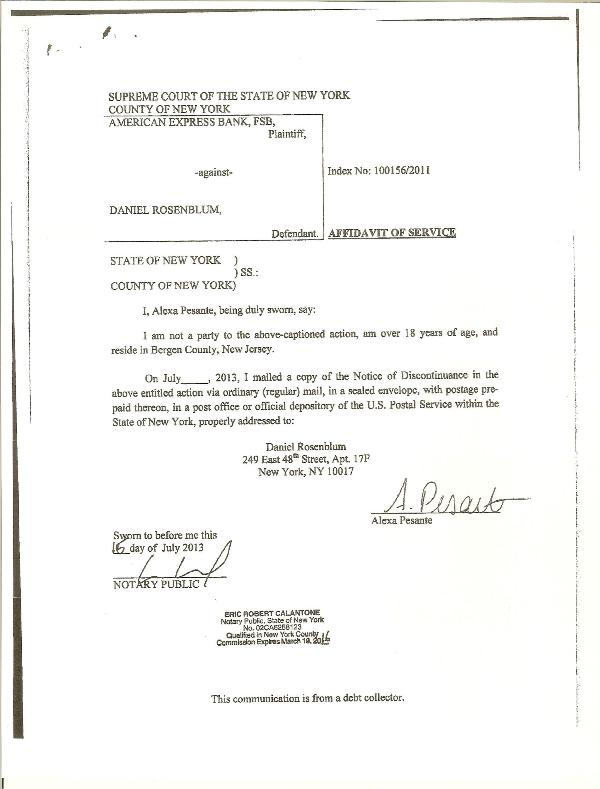

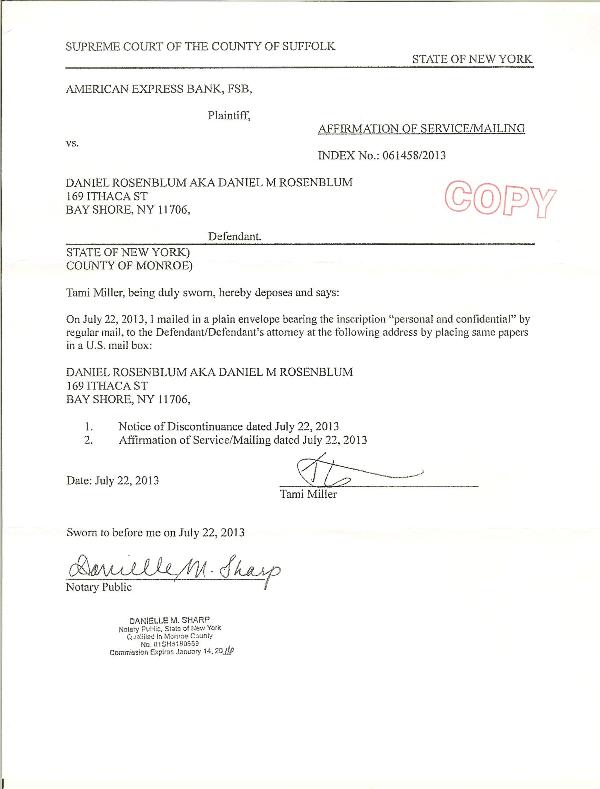

Oddly, however, the Offices of Jaffe and Asher, attorney for Plaintiff American Express, has filed with the New York County Clerk a "Notice of Discontinuance" purportedly in accordance with CPLR 3217(a)(1). Similarly, the firm of Zwicker and Associates filed the same notice citing the sae CPLR within a week of the Jaffe Discontinuance with the Suffolk County Clerk. In one respect the Zwicker CPLR 3217 Notice of Discontinuance might be considered a valid filing given that by some calculations their Summons and Complaint might be calculated to be within 20 days of their service of summons and complaint. However, that seems only if their Summons and Complaint were actually a valid legal filing, due to the fact that I had told Zwicker over several months that the subject matter was in New York Court. On the other hand, the Jaffe Discontinuance comes over two years following my responsive pleading, an Affidavit in Opposition filed April 2011. Below I have images of most of the pertinent filings in the current matter in New York Supreme Court Index # 100156/2011. Specifically, there are images of the Zwicker and Jaffe Discontinuance notices of July 2013, decisions in the Index file by Judges Goodman and Hagler, my April 2011 Affidavit in Opposition, the Zwicker June 2013 Summons and Complaint, and one or two more items from the case file. I am the defendant in the matter, and am Pro Se.

Lastly, interdispersed with the images of the Index file are some commentary by me and links to documents I intend to file in the matter in support of my tolling motion; this is because I am of the strong understanding that the just result in this legal action is a stay of all procedure until such time that I can pay American Express in full, as described and because of what is described variously below and in the supporting documentation:

American Express as lender must have an expectation of earnings by the borrower associated with the dollar amount loaned or on loan or granted as credit, approved as credit. Here, what would have been the average expectation of earnings associated with a $36,000.00 line of credit? Over a 5 year, 10 year, or 15 year period average expected earnings per borrower ? I have discussed with Hoeffherr at Jaffe, as well as with representatives of Amex and Zwicker and Jaffe the notion that I intend to pay American Express back, and that the 'just" adjudication would have me do so when earnings are at least in line with projections for earnings expectations associated with a $36,000.00 line of credit. I have discussed with Hoeffherr at Jaffe as to the Credit Reporting Agencies and this line of credit and my inability to rent a car nationwide, as well as the fact that I do not own a motorized vehicle but rather use a bicycle for my seven mile commute to work daily. Further, I have indicated that when my income goes up from $ 14.75 purchases of a vehicle and perhaps even home ownership should take precendence over an alottment of monies to American Express and Jaffe and Asher if there were a default judgement. In a few pages from now, is an image of my nine page April 2011 Affidavit in Opposition.

I have discussed with Hoeffherr at Jaffe the notion that at Zwicker and Jaffe these "law firms" have applied a cost benefit analysis to debt collection which is impermissable. That is, as businesses their analysis determined it is more profitable to devote scarce resources to filing summons and complaints rather than to the diligence required by attorneys in the practice of law and interaction with the courts and judicial system. (that is to say, perhaps a five star michelin guide restaurant can cut costs by opening a chain. In cutting costs, the quality may go down. Jaffe is not entitled to simply suffer the consequences the way the restaurant does given that clientele might dine elsewhere. Jaffe may not cut costs which sacrifice diligence in the practice of law as technology has advanced. Scarce resources of a firm must first be devoted to diligent practice of law, and only then can the additional resources be devoted to profit increasing measures- which always should come second to diligence. No actual diligece should be sacrificed because scarce resources have been priortized towards profit increasing measures such as spending on dial-out phone systems, or dial-out phone systems which can record dialogue with a borrower presumably in accordance with some debtor law disclosed by Zwicker Associate dialers. In no instance in the collection process does a borrower have the option to have recorded dialogue available albeit Zwicker or Jaffe purportedly utilizes recorded telephone dialogue in the legal collection process. Here, I specified to Zwicker Associates dialers during purportedly recorded dialogue that the subject matter about which they were speaking to me was in litigation in Manhattan, over a period of several months. Yet Zwicker filed a Summons and Complaint in June 2013, and then a Notice of Discontinuance (rather than the appropriate Motion for Dismissal) one month later following several hours of work on my part to convince Amex and Zwicker that the subject matter was under litigation therefore illegal to file the complaint. This is a blatant example of misappropriation of scarce resources in a law firm towards increasing profit rather than diligent practice of law. In a small firm where an attorney is keeping tabs on a matter entrusted to him as attorney for such matter could not feasibly be told over several months that an account is in litigation but then go and commence an action purportedly on behalf of such client. Zwicker has misappropriated scarce resources in a manner unexceptable in the practice of law. Professional Responsibility in the practice of law may not be sacrificed as part of the operations stratgey of a firm. You cannot cost cut Professional Responsibility and continue to practice as attorney. Stephen Bann might say that his office is in Rochester and he was unaware of the information the debt collector callers at his firm had garnered when he commenced the action with a summons and complaint. If an attorney were actually representing a client in a subject matter at issue, the attorney would and should have had some sort of meeting of the minds as to the action with the client. Here the client is American Express. I need more information into how or why or what facet of Zwicker Associates operations was the impetus for the Rochester Office of Zwicker to commence the action. I have a similar criticism insofar as the Jaffe July Notice of Discontinuance, 27 months after my Affidavit in Opposition and two judicial decisions when it comes to scarce resources at a firm.

Please note above that Jaffe Discontinuance dated July 15th is by Jaffe attorney Eric Calantone, and the Jaffe attorney Calantone is also the Notary on the Affidavit of Service for that discontinuance, and that neither has the correct address for Daniel Rosenblum as it is listed in the court records since April of 2011.

It does indeed puzzle me how the hundreds of employees at firms like Jaffe and Zwicker earn full time salaries as debt collectors- that is- presumably their companies are not in debt but their salaries are all derived from debtors who had trouble in the first place paying back a loan. Now the debtors are not only paying back the loan, but, Zwicker or Jaffe has added cost to that loan. Personally, I do not believe it would be just for a decision in New York State Supreme Court to have me pay costs associated with Jaffe's filing of an invalid discontinuance and costs associated with Zwicker's collectors dialing and dialing and dialing. In my opinion, these debt collectors have isolated a business model which gives them a piece of the "pie" (monies associated with consumer debt nationally) but which is hardly the practice of law. Debt collectors like Zwicker and Jaffe have devoted scarce firm resources to debt collection telephone dial services and filing Summons and Complaints but are sacrificing the costs associated with the actual practice of law: diligence, familiarity with case subject matter, familiarity and compliance with statutes, avoiding non-frivolous filings, etc.

I have discussed with representatives of Amex, Zwicker, and Jaffe the fact that I see certain practices of their client American Express as problematic, as a cost to the US economy insofar as they are a Bank deriving reveues from non-banking commercial activities, specifically from financial data processing. I have indicated to Jaffe, Amex, and Zwicker that I have written on the subject matter as a result of the business initiative of 21st Century Digital, my claim on Citibank from 1998, and my interest in the subject matter towards facilitating for myself a productive, efficient career in law, business, banking, and internet technologies. In support of my tolling motion in Index 100156/2011 I therefore intend to reference and file several documents here listed, with links to the document webpage on www.twentyfirstcenturydigital.com:

January 2008 By: Daniel Rosenblum

Title: Bank Holding Companies and Antitrust Regulation: Contemplating Market Power, Relationship Management, and Mixed Products in 2007 (24 Pages Dual Column)

Submitted to David Glass, Professor, New York Law School, as requirement for Law School Independent Study for academic credit, and, possibly publication in NYSBA (NY State Bar Association) Business Law Journal Spring 2008 edition (subsequently not published in that or any other journal).

Contemporaneously to writing the "Mock App" for law school, I submitted an application to the Board of Governors of The Federal Reserve for TTS Industries to become a BHC engaged in the non-banking activity performing the commercial service of a network administrator while a BHC. Essentially, such an application and approval by the Fed is one example of a business model which would assist in regulating internet commerce and resolve the problems I write about above insofar as BHCs presently processing financial data in the current regulatory environment which does not properly address the Permissible Activities doctrine or Section 106 doctrine. Here is a link to the document as sent to the Board of Governors in Washington DC in December 2008:

Have discussed with Hoefherr at Jaffe that Rosenblum desires to again utilize an American Express Card or the services associated with holding an Amex, a Visa, or a Mastercard. The Credit Reporting Agencies system in turn supports the business model which minimizes using the courts to adjudicate and make precedent. Thus the earnings of these banking entities is the bottom line rather than the end services associated with the processing of data as a revenue producing service. If the provider of such services were not a lender, then, properly, the $5 billion in revenues for the data processor would drive an engine of productivity insofar as consumer data processing rather than manipulated on the books of these banks in part supporting this bad lending or lending which simply has the end result of burdening the economy with a cost- a tax- with no benefit accruing but to lenders. The monies would have been spend anyway by consumers, here there's just added interest.

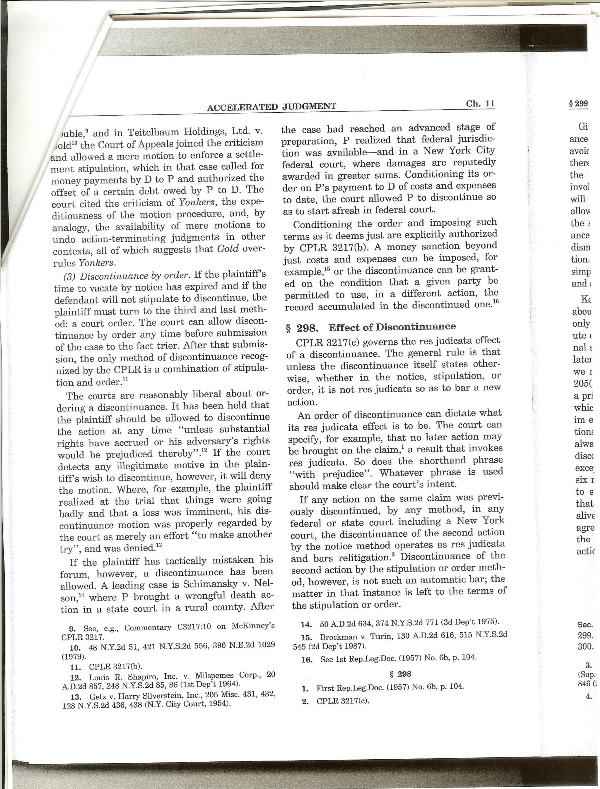

Below, the next few pages images are the New York Practice citations on Discontinuance, including the Stipulation of Discontinuance. I have indicated succinctly to Jaffe that separate from the "just" decision granting a stay of procedure in this matter, I believe a "just" resolution would be a Stipulation of Discontinuance which I would sign if I had monies in pocket equivalent to the expected earnings over a 5 to 7 year period for a borrower qualified for a $36,000.00 American Express line of credit. My rough estimate of those earnings (not including an estimate for earnings for 21st Century Digital over the five to seven year period, but, rather, simply practicing in the field of law as an over achiever during 2006 to 2013 with a JD and MBA) rough estimate of $1 million. I have indicated that I would have no problem signing a stipulation of discontinuance if I had $ 1 million in pocket regardless of the source of such monies- or a contract equivalent to the same- of which I would remit immediately $ 52,000 to American Express. Alternatively, the "just" resolution at present would be a stay on proceedings, which I am writing as my Tolling Motion and which I intend to file with New York County Supreme Court for decision in Index 100156/2011 American Express vs. Daniel Rosenblum shortly.

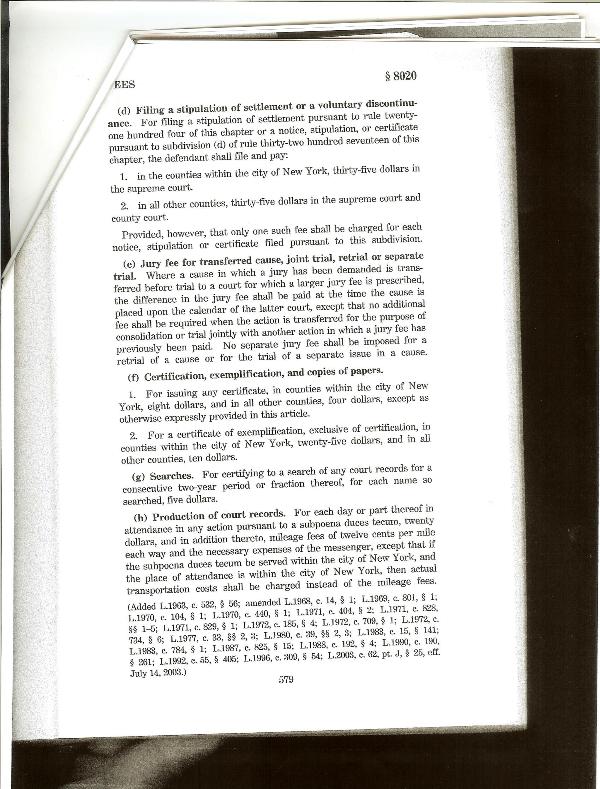

Here is the CPLR Section 8020 which describes the fees associated with the County Clerk filing a Stipulation of Discontinuance with the Supreme Court. In my discussions with Hoffher at Jaffe, Hoffher has stated that he believes the Notice of Discontinance will carry weight with the Judge in the case, and that his firm has begun collection activities anew presently as the subject matter of the debt is no longer in litigation. I, alternatively, have stated to Hoffher that the Judge has not seen and will not consider the Notice of Disclosure because the County Clerk has not moved it to Supreme Court. The filing is defective. Presently, it seems to e I have the choice to pay a filing fee for a notice of stipulation or for a notice of motion (my tolling motion).

After Zwicker filed in Suffolk on the same subject matter as Jaffe in NY, I contacted Zwicker, Suffolk, and American Express. It was not easy. The email below indicates my contact at Amex Global Credit on Monday July 22:

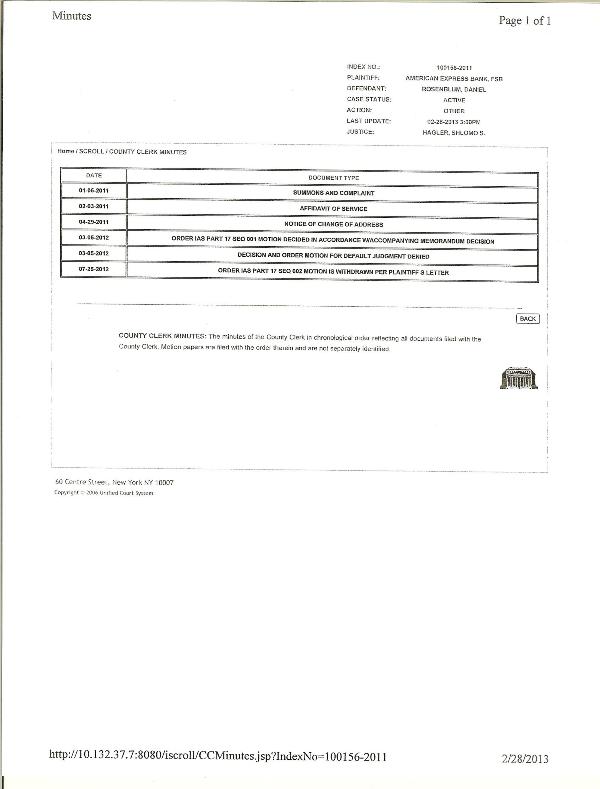

On February 28th of 2013 I reviewed the computer system at 60 Centre Street to gain knowledge into the status of the pending case, Index 100156/2011. Below is a printout of the County Clerk Minutes on the index showing the decisions and orders in the case, as well as my April 2011 change of address in their system. Jaffe did not update their system to reflect my address change until the last week of July 2013.

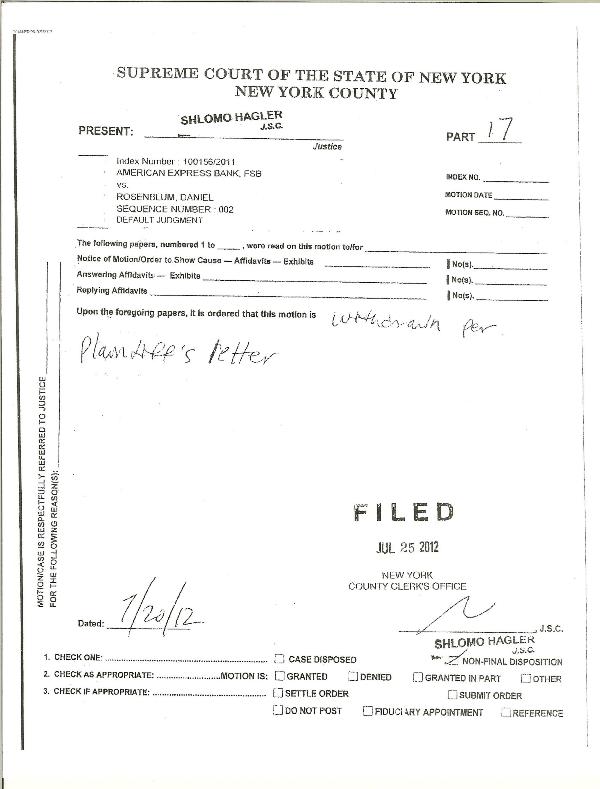

Here is an image of the Judge Hagler decision of July 2012:

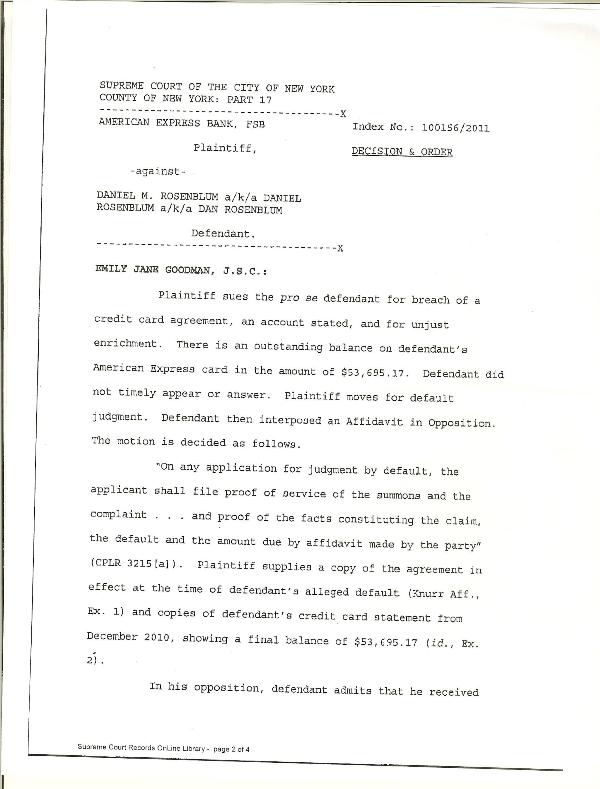

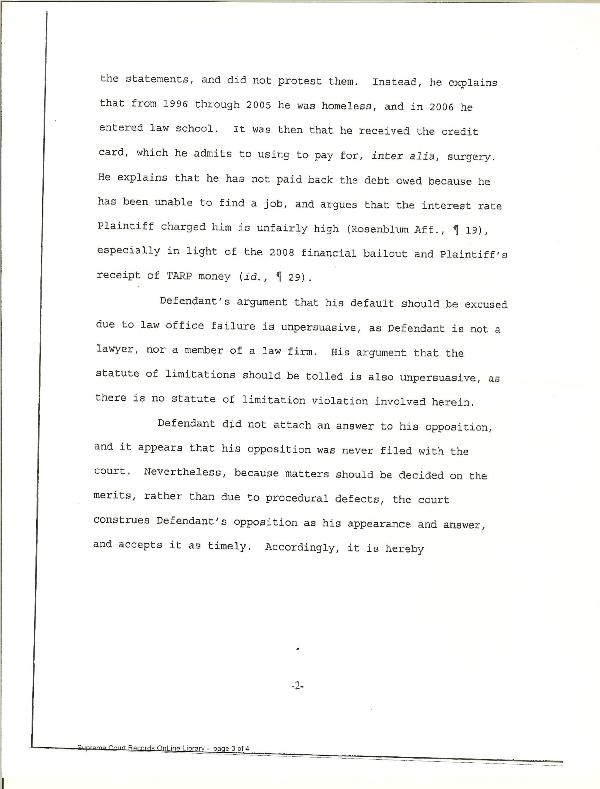

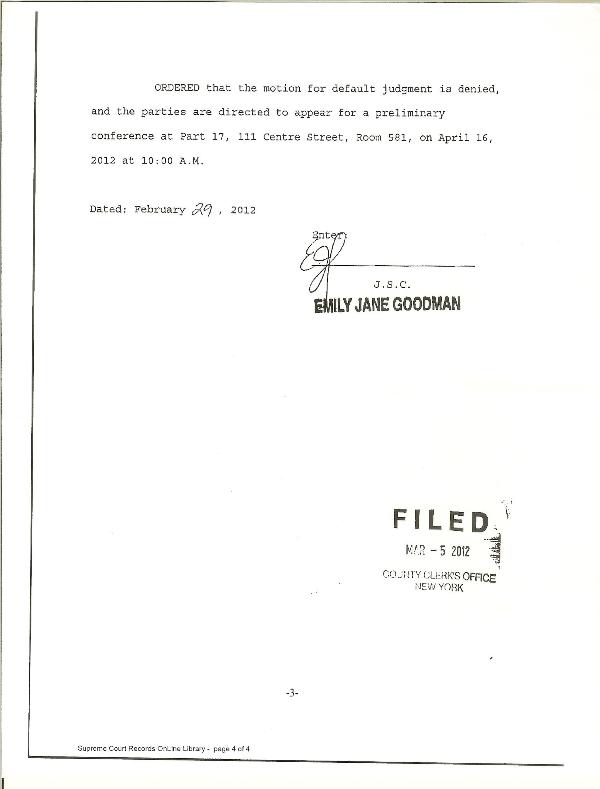

Here is a copy of the three page Judge Goodman decision of February 2012:

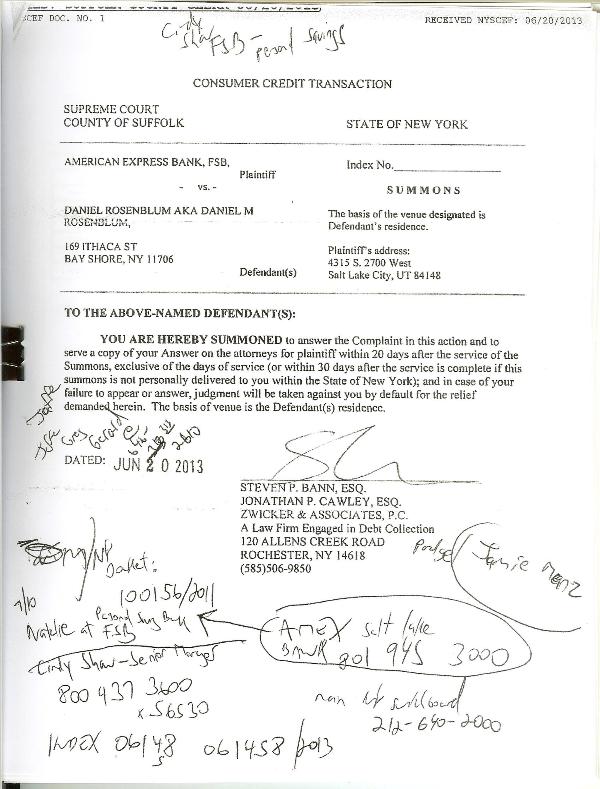

Here is the June 2013 Zwicker Summons and Complaint:

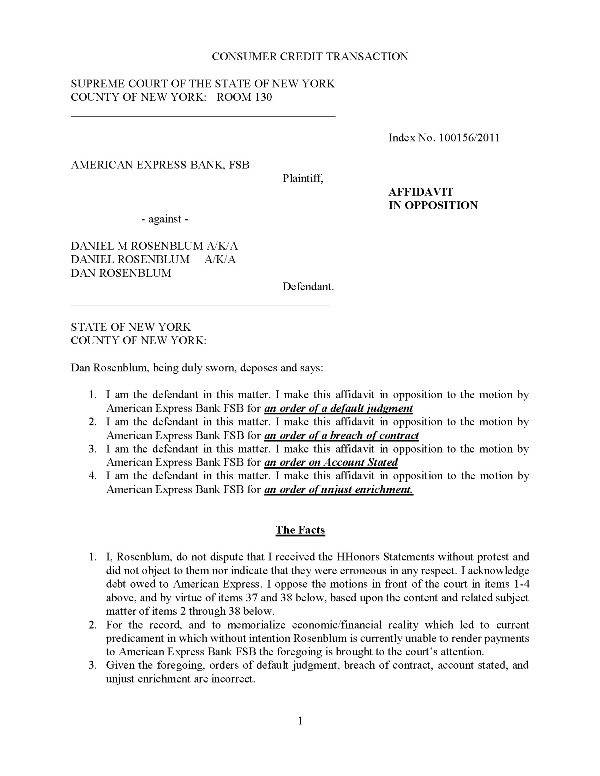

Here is my April 2011 9 page Affidavit in Opposition to the Summons and Complaint:

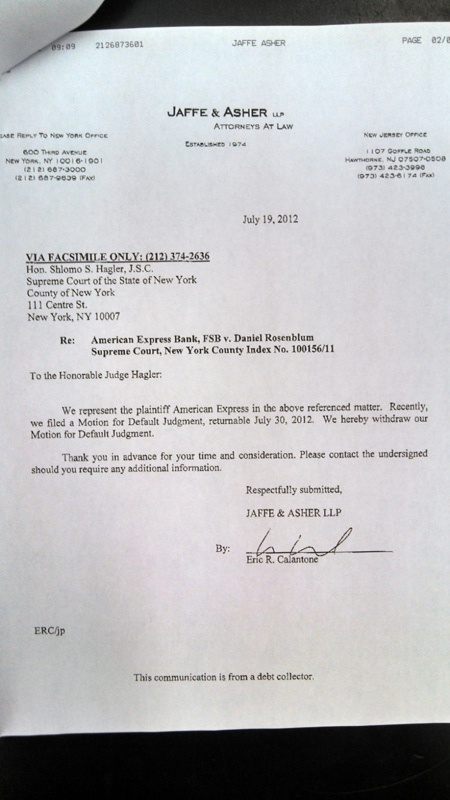

Here is a copy of the Jaffe and Asher July 2012 letter that Judge Hagler's decision was based on: